unemployment tax refund update october

This is your tax refund unemployment October. The income threshold for being.

3 Dates That Could Influence The Stock Market In October The Motley Fool

This is your tax refund unemployment October 2021 update.

. Hi there Its been almost 2 years since the 2020s 10200 Dollar Unemployment Income Exclusion Tax Deduction take into effect I was told in 2021 that people who filed earlier than that March. Thats the enviable situation for a number of taxpayers this week. To calculate your payment go to the states website and click on.

To be eligible you must have filed your 2020 tax return by last October and make less than 150000 per year. IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline. Direct deposit recipients who have changed banking information since filing their 2020 tax return.

October 28 2021 Taxes By Noel B. One you were unemployed in 2020. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross.

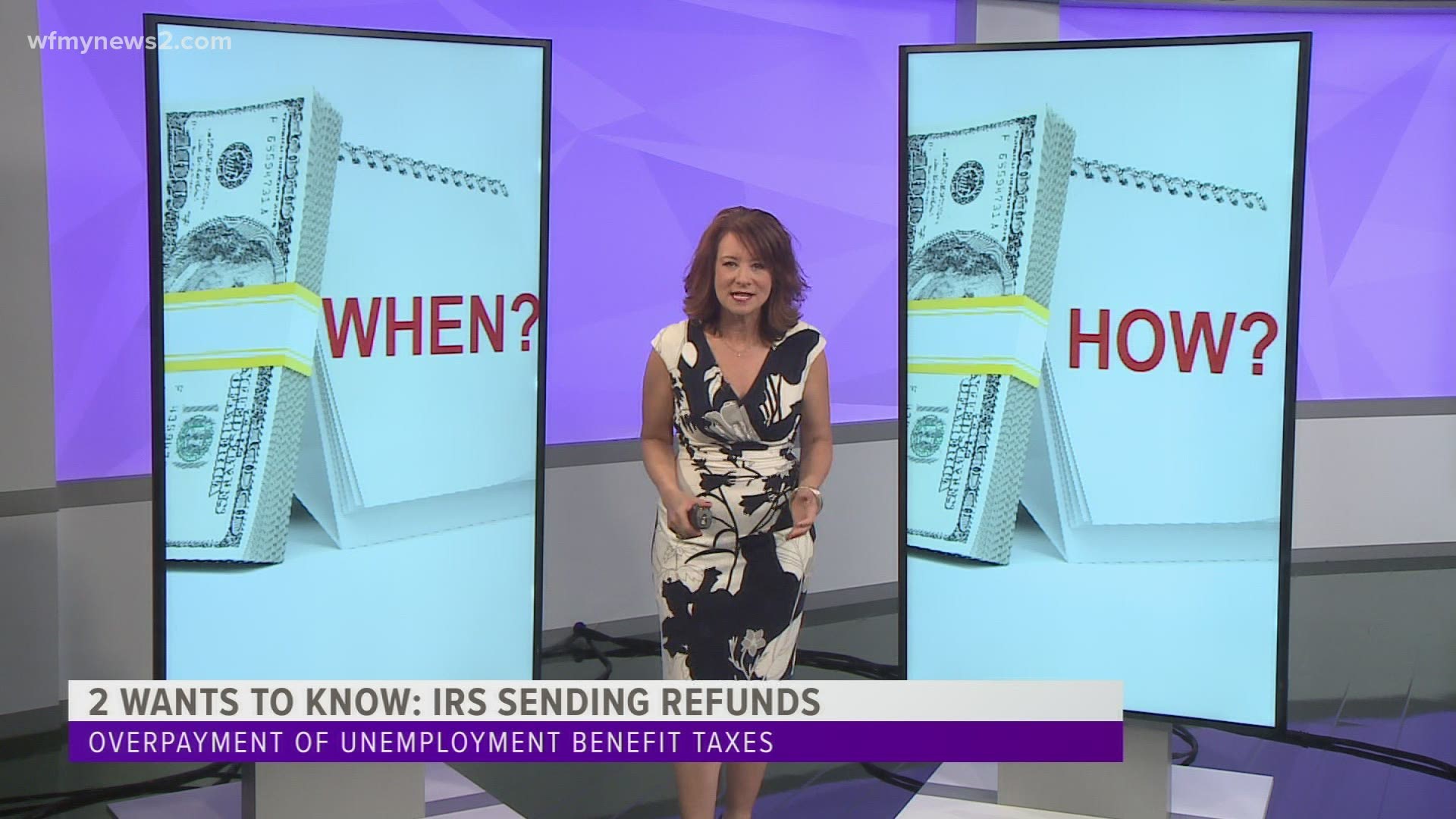

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Federal Unemployment Tax Act FUTA Information for Wages Employers Paid in 2022 October 27 2022 Interest Rate Announced. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

Two you paid taxes on that unemployment benefit in 2021. Here are the three things you need to qualify for one of these refunds. 8 hours agoDates to be announced.

Only one set of. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits. This is your tax refund unemployment October 2021 update.

In summary if you received unemployment. In continuation of the benefit introduced by the Consolidated Appropriations Act 2021 the ARPA allows for an additional weekly benefit of 100 in Mixed Earner Unemployment. What better way to start your morning than with a surprise check from the government.

And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. The interest rate charged on all delinquent. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

This is your tax refund unemployment October 2021 update. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. How to check your irs transcript for clues.

The American Rescue Plan made it so that up to 10200 of unemployment benefit received in 2020 are tax exempt from federal income tax.

What Does Tax Topic 203 Mean Where S My Refund Tax News Information

Filing Taxes In 2022 Irs Deadline Tax Credits Unemployment And Tips

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

If You Were On Unemployment Last Year You Ll Probably Get A Tax Break Marketplace

Unemployment Tax Refunds More Checks Heading Out This Weekend The National Interest

Tax Day 2022 10 Tax Changes That Could Impact The Size Of Your Refund Cnet

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Federal Income Tax Refunds May Be Delayed By Stimulus Mistakes Paper

2022 Federal Payroll Tax Rates Abacus Payroll

Fafsa Treatment Of Unemployment Benefits In 2021 And Beyond

12 Reasons Why Your Tax Refund Is Late Or Missing

Unemployment Tax Refund Update What Is Irs Treas 310 10tv Com

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back